Best P2P Crypto Exchange Platforms in 2025

-

Why P2P Matters in 2025

-

How We Selected the Best Platforms

-

Top P2P Exchanges in 2025

-

4.1 Binance P2P

-

4.2 OKX P2P

-

4.3 KuCoin P2P

-

4.4 Bybit P2P

-

4.5 Paxful

-

4.6 Best Wallet (No-KYC mobile)

-

4.7 BingX

-

4.8 MEXC

-

4.9 Privacy‑focused: Haveno & Peach Bitcoin

-

-

Key Evaluation Criteria

-

Fees & spreads

-

Liquidity & volume

-

Payment methods & fiat coverage

-

KYC vs no‑KYC models

-

Security & escrow

-

Mobile/Web UX

-

-

In‑Depth Platform Reviews

-

A. Binance P2P overview & features

-

B. OKX P2P analysis: zero-trading fees

-

C. KuCoin: global reach & app usability

-

D. Bybit: beginner‑friendly & fast KYC

-

E. Paxful: deep payment method support

-

F. Best Wallet: mobile, anonymous, fastest rates

-

G. BingX: USDT-only + bots Copy Trading

-

H. MEXC: bonus airdrops & altcoin depth

-

I. Haveno/Peach BTC: privacy-first, Lightning openness

-

-

Security, Scams & Risk Mitigation

-

How to Choose the Right P2P Exchange

-

Step‑by‑Step Guide to P2P Trading

-

Future Trends & Regulatory Outlook

-

FAQs

-

Conclusion & Final Rankings

-

Appendices: Glossary, Tax Alerts, Regional Notes

1. Introduction to P2P Crypto Exchanges

Peer-to-peer (P2P) crypto platforms let buyers and sellers directly trade crypto using fiat and local payment methods. These platforms offer privacy, flexibility, and often no or minimal trading fees. They rely on escrow to secure deals, giving users control without relying on centralized order books.

2. Why P2P Matters in 2025

From banking exclusion to privacy concerns and newer layers of regulation, P2P trading has surged. In many regions—like parts of Africa, Asia, LatAm—users prefer direct fiat-to-crypto methods. P2P also preserves user anonymity, supports remote regions, and circumvents bank bans.

3. How We Chose the Best Platforms

We reviewed 20+ platforms using criteria like:

-

Security, escrow system & track record

-

Liquidity & volume data

-

Range of fiat currencies & payment options

-

Fee transparency

-

Decentralization/privacy features

-

Regulatory compliance

-

User experience on mobile & web

We cross-referenced sources like CoinSpeaker, Bitcoin.com, FXEmpire, ICObench, Gate, Reuters and academic studies bitcoin.com+1nadcab.com+1en.wikipedia.org+15coinspeaker.com+15vocal.media+15koinly.ioarxiv.org+1koinly.io+1nadcab.comicobench.comfxempire.com.

4. Top P2P Exchanges in 2025

4.1 Binance P2P

-

Highlights: Zero fees, 100+ fiat currencies, 1,000+ payment methods fxempire.com.

-

Integration with Binance ecosystem—access to central exchange, savings, futures.

-

High liquidity globally; strong escrow system and user-rating system.

-

Best use case: buy stablecoins or BTC fast with local bank transfers or e-wallets.

4.2 OKX P2P

-

Zero trading fees, block trade features for large amounts coinspeaker.com.

-

Widely used in Asia; rapidly expanding cross-border escrow.

-

Strong UX, responsive seller options, smooth KYC onboarding.

4.3 KuCoin P2P

-

Supports five leading coins (USDT, USDC, BTC, ETH, KCS) + 100+ pay methods fxempire.com+1koinly.io+1fxempire.com+2coinspeaker.com+2icobench.com+2.

-

Great app, beginner-friendly.

-

Global user base of 40M+, daily volume >$5B nypost.com.

-

Must complete ID verification, recently exited US market (Jan 2025).

4.4 Bybit P2P

-

No P2P fees, seller discounts via vouchers coinspeaker.com+1fxempire.com+1.

-

Simple interface, fast onboarding.

-

Part of larger Bybit ecosystem: derivatives, staking.

-

Note: minor 2025 security incident, no customer losses icobench.com+5coinspeaker.com+5fxempire.com+5.

4.5 Paxful

-

Over 300 payment methods, gift cards & bank transfers nadcab.com+1coinspeaker.com+1.

-

Strong in Africa, LatAm; escrow & dispute mediation tools.

-

Medium spreads but excellent payer coverage.

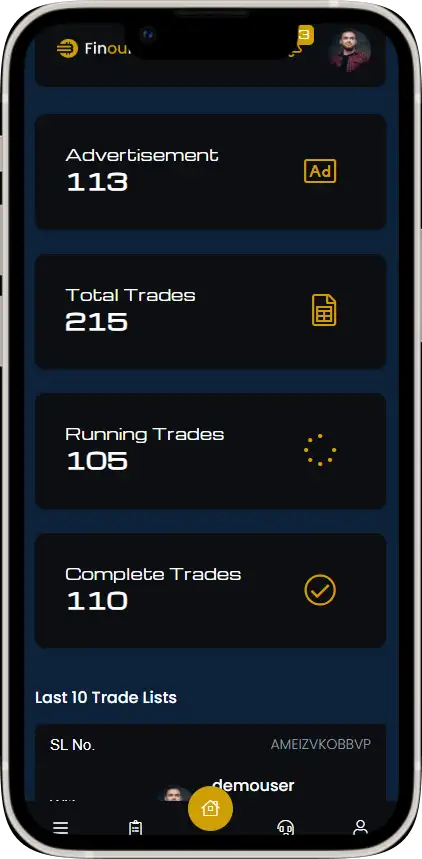

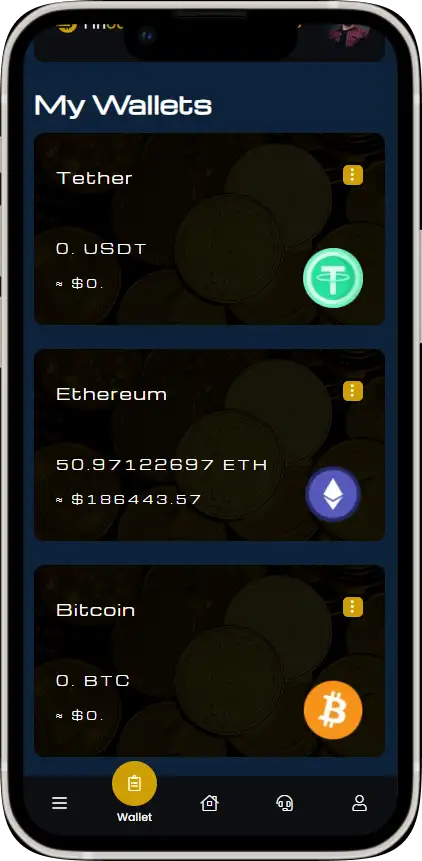

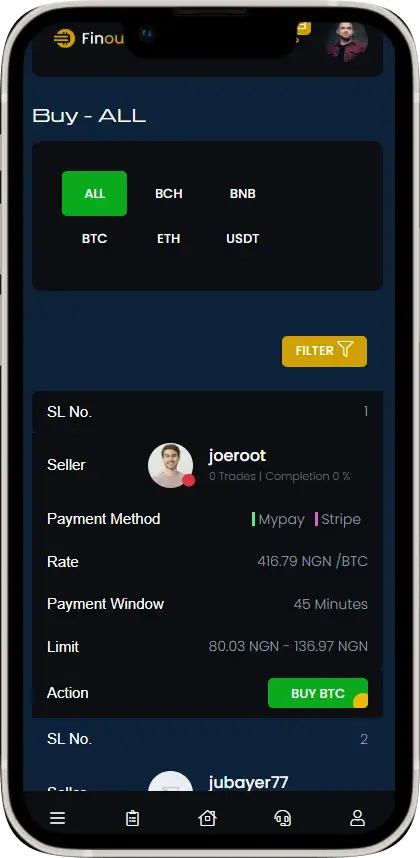

4.6 Best Wallet (No-KYC mobile P2P)

-

Top-reviewed mobile-first P2P platform fxempire.combitcoin.com+2icobench.com+2fxempire.com+2coinspeaker.com+1arxiv.org+1.

-

Supports 1,000+ coins, 100+ payment types, 30+ local currencies.

-

Non-custodial wallet, full privacy; best rates via aggregated liquidity.

-

No KYC required, but limited backup options.

4.7 BingX

-

USDT-only P2P, but 300+ payment methods and 65 fiat currencies nypost.com+4coinspeaker.com+4koinly.io+4.

-

Offers leveraged trading, grid bots, copy trading on main platform.

-

Trades complete in under 10 min; great for quick stablecoin buys.

4.8 MEXC

-

4,000+ trading pairs, regular airdrops for P2P users coinspeaker.com.

-

Low fees, moderate liquidity outside major fiat corridors.

4.9 Privacy-focused: Haveno & Peach Bitcoin

-

Haveno: Decentralized P2P Monero exchange over Tor, escrow, privacy-first koinly.io+1arxiv.org+1.

-

Peach Bitcoin: Mobile-only, non-custodial, Swiss-regulated, no KYC youtube.com+7koinly.io+7bitcoin.com+7.

-

Both better for small‑to‑medium trades; limited liquidity vs fiat-heavy platforms.

5. Key Evaluation Criteria

a) Fees & Spreads

-

Binance, OKX, KuCoin, Bybit = zero P2P fees.

-

Paxful & BingX may have small spreads.

-

Best Wallet offers best rates via liquidity sourcing.

b) Liquidity

-

Binance > KuCoin > OKX for major fiat.

-

Paxful excels in gift cards and regional payments.

-

Haveno & Peach Bitcoin best for privacy but low liquidity.

c) Payment Methods

-

Binance supports 1,000+, Paxful 300+, BingX & MEXC 300+.

-

Best Wallet covers local bank, cards, e-wallets.

-

Haveno & Peach BTC limited to crypto on‑ramps.

d) KYC vs No‑KYC

-

No‑KYC: Best Wallet, Peach Bitcoin, Haveno.

-

KYC required: Binance, OKX, KuCoin, Bybit.

-

Paxful optional depending on volume/method.

e) Security & Escrow

-

All top-tier options use escrow.

-

Decentralized apps rely on smart contracts; centralized rely on custodial escrow.

-

Privacy-first ones rely on Tor/encryption; user responsibility is key.

6. Security, Scams & Risk Mitigation

-

Always confirm on‑chain receipt before releasing fiat.

-

Check seller ratings, transaction volume.

-

Avoid offline/cash-in-person deals.

-

Use platforms with dispute resolution (Binance, Paxful).

-

Limit trade amounts with new/unknown sellers.

7. Step-by-Step Guide to P2P Trading

-

Choose the platform by priorities (e.g. privacy, fiat reach, fees).

-

Complete KYC if required.

-

Browse offers, filter by pays, currencies, limits, ratings.

-

Initiate trade, confirm terms (price, amount).

-

Transfer fiat via instructed method.

-

Confirm payment, check escrow, release crypto.

-

Leave feedback/rating for seller – it’s community-based trust.

8. Future Trends & Regulatory Outlook

-

Privacy tools (Haveno) under pressure from global regulations.

-

Emerging P2P on-chain (Lightning, cross-chain bridges).

-

Institutional usage adopting P2P for compliance & on/off-ramp flexibility.

-

Increasing regional fiat support (e.g. PayPal integration, local e-wallets).

9. FAQs

-

Q: Which P2P has lowest fees?

Zero-fee platforms: Binance, OKX, KuCoin, Bybit. -

Q: Are P2P exchanges legal?

Mostly yes—subject to local crypto & KYC laws. No-KYC options may risk tax or regulator attention. -

Q: How swift is P2P settlement?

Usually 10‑30 minutes depending on method and verification. -

Q: Which supports anonymous crypto?

Haveno & Peach BTC for Monero/BTC, no personal data needed.

10. Conclusion & Final Rankings

11. Appendices

-

Glossary: escrow, spread, fiat, KYC, Taker/Maker, stablecoin.

-

Tax Note: P2P trades are taxable events—keep records.

-

Regulatory Update: Local country bans may affect P2P channels.