How to Convert Crypto to Fiat: Full Guide for 2025

Converting cryptocurrency to fiat money—like USD, EUR, BDT, or INR—has become faster, safer, and more accessible than ever. Whether you're holding Bitcoin, Ethereum, or stablecoins like USDT, getting your digital assets into your bank account or mobile wallet is now easier through exchanges, P2P platforms, crypto cards, or even local brokers. This in-depth 50+ world guide covers everything you need to know in 2025 to successfully convert your crypto into real-world currency without losing value or facing unnecessary risks.

What Is Crypto-to-Fiat Conversion?

-

Top Methods to Convert Crypto to Fiat in 2025

-

Using Centralized Exchanges (Binance, Coinbase, etc.)

-

Peer-to-Peer (P2P) Platforms for Fiat Withdrawal

-

Crypto Debit Cards & Fiat Gateways

-

Decentralized Ways to Convert Crypto

-

Converting USDT, BTC, ETH Specifically

-

Local Bank Transfer & Mobile Money Options

-

Legal & Tax Implications

-

How to Stay Safe from Scams

-

Pros & Cons of Each Method

-

Future Trends in Crypto to Fiat Conversion

-

Frequently Asked Questions (FAQ)

-

Final Thoughts

🪙 1. What Is Crypto-to-Fiat Conversion?

Crypto-to-fiat conversion means exchanging your digital assets (cryptocurrencies like Bitcoin, Ethereum, USDT, etc.) for traditional government-issued money like USD, EUR, BDT, or INR. It allows crypto holders to cash out their digital wealth into real-world currency for spending, saving, or investment purposes.

🏦 2. Top Methods to Convert Crypto to Fiat in 2025

In 2025, the most reliable ways to convert crypto to fiat include:

-

Centralized Exchanges (CEX)

-

Peer-to-Peer (P2P) platforms

-

Crypto Debit Cards (Visa/Mastercard)

-

Local OTC Agents or Brokers

-

Crypto ATMs

-

Mobile Wallets & Bank Withdrawals

🔁 3. Using Centralized Exchanges

Platforms like Binance, Coinbase, Kraken, and Bybit offer direct crypto-to-fiat services. Here's how:

✅ Steps:

-

Register & complete KYC

-

Deposit your crypto (e.g., BTC, USDT)

-

Sell crypto for fiat (e.g., USD, EUR)

-

Withdraw to bank account

📝 Pros:

-

High liquidity

-

Secure

-

Fast execution

❌ Cons:

-

KYC required

-

Bank withdrawal charges

-

Some countries restricted

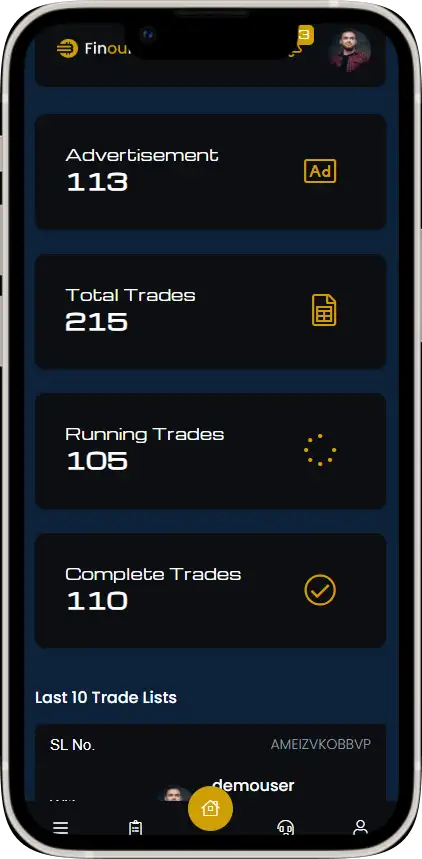

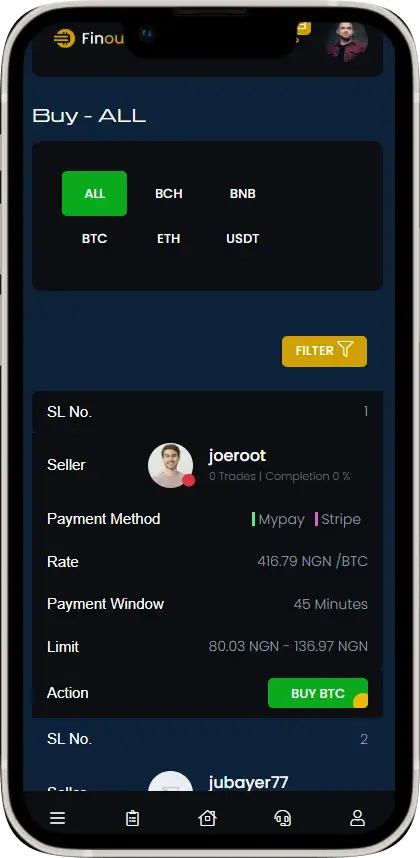

🧑🤝🧑 4. Peer-to-Peer (P2P) Platforms

Want to sell crypto without KYC? Try Binance P2P, Paxful, Remitano, or LocalBitcoins.

✅ How It Works:

-

List your crypto for sale

-

Choose buyer with good rating

-

Receive fiat via bank, mobile wallet, or cash

-

Release crypto only after payment

🔒 Tips:

-

Always use escrow

-

Never chat outside platform

-

Screenshot everything

💳 5. Crypto Debit Cards

Services like Crypto.com, Wirex, or Binance Card allow you to load crypto and spend as fiat directly.

📌 Features:

-

Spend in stores and online

-

ATM cash-out

-

Instant conversion at POS

💡 Limitations:

-

Not available in every country

-

Monthly/card fees may apply

🔁 6. Decentralized Ways to Convert Crypto

If you're privacy-focused:

-

Use DEXs (like Uniswap) to swap to stablecoins

-

Use DeFi bridges to access fiat gateways

-

Avoid centralized tracking, but higher risks

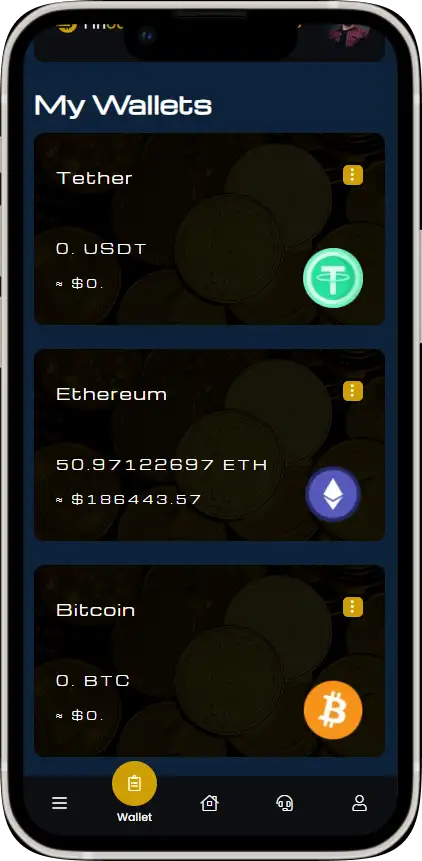

💱 7. Specific Crypto Conversion (USDT, BTC, ETH)

-

USDT → Fiat: Best through Binance P2P, local brokers

-

BTC → Fiat: ATMs, centralized exchanges, OTC

-

ETH → Fiat: Best via Coinbase, Kraken

Always compare fees and rates before converting.

🏦 8. Local Bank Transfer & Mobile Money

In countries like Bangladesh, India, Nigeria, Kenya:

-

Use bKash, Nagad, GPay, UPI, or M-Pesa

-

Local P2P traders or OTC agents offer direct exchange

-

Verify trusted vendors with reviews

📜 9. Legal & Tax Implications

-

Some countries require you to declare crypto profits

-

Keep records of transactions

-

Check if you need to pay capital gains tax

🔐 10. How to Stay Safe from Scams

-

Never release crypto before receiving payment

-

Double-check wallet addresses

-

Don’t trust unknown Telegram/WhatsApp buyers

-

Use only verified platforms

⚖️ 11. Pros & Cons of Each Method

📊 12. Future Trends

In 2025 and beyond, crypto-fiat conversion is moving toward:

-

Real-time bank integration

-

Global stablecoins with fiat gateways

-

AI fraud detection in P2P

-

CBDC-to-crypto hybrid rails

❓ 13. FAQ

Q1: What’s the cheapest way to convert crypto to fiat?

A: P2P is often cheapest if you avoid high platform fees.

Q2: Can I convert without KYC?

A: Yes, through P2P platforms or local brokers.

Q3: Is converting USDT to BDT possible?

A: Yes, via Binance P2P or local traders in Bangladesh.

🧠 14. Final Thoughts

Converting your cryptocurrency into fiat is now safer and faster than ever before. Whether you want to use a trusted exchange or a private peer-to-peer deal, the key lies in choosing the method that balances security, speed, and cost. Stay alert for scams, check conversion rates, and always use platforms with strong reputations. With the right approach, your crypto wealth can seamlessly enter the real world.

🌍 15. Country-wise Guide to Convert Crypto to Fiat

Cryptocurrency adoption is global—but fiat conversion methods vary by country. Let’s break down how people in different regions cash out their crypto in 2025:

🇺🇸 United States:

-

Use Coinbase, Kraken, or Robinhood for direct USD withdrawals.

-

Crypto cards like Crypto.com Visa widely accepted.

-

Bank integration is seamless.

🇬🇧 United Kingdom:

-

Use Binance UK, Revolut, or Bitstamp.

-

GBP withdrawals are fast.

-

P2P options limited due to regulation.

🇧🇩 Bangladesh:

-

Popular platforms: Binance P2P, Localbitcoins, Facebook groups.

-

Mobile money services: bKash, Nagad.

-

Trusted OTC brokers operate manually.

-

No local exchange license—use caution.

🇮🇳 India:

-

Use WazirX, Zebpay, or Binance P2P.

-

Withdraw to UPI or IMPS.

-

Legal grey area but actively used.

🇳🇬 Nigeria:

-

Crypto highly used due to inflation.

-

Binance P2P is most active.

-

Bank transfers banned by CBN, so use P2P and local wallets.

🇵🇭 Philippines:

-

Use PDAX, GCash, Coins.ph.

-

Crypto cards supported.

-

Crypto income taxable.

💡 16. Real-Life Example: How Ahmed Converts USDT to BDT in Bangladesh

Let’s take a fictional example of Ahmed, a freelancer from Dhaka earning in USDT.

🔹 His situation:

-

Receives $500 in USDT monthly.

-

Wants to cash out in BDT without paying heavy fees.

🔹 His Steps:

-

Logs in to Binance P2P.

-

Selects “Sell USDT” and chooses buyer with >1000 orders and 95%+ rating.

-

Selects bKash as payment method.

-

Inputs $500 and waits for buyer to pay ~63,500 BDT.

-

Once bKash payment is confirmed, he clicks “Release USDT”.

✅ Result: Ahmed converts $500 in USDT to BDT with zero exchange fees, in under 15 minutes.

📉 17. Understanding Conversion Rates & Hidden Fees

To maximize your crypto-to-fiat exchange value, keep the following in mind:

📌 Pro Tip: Always check the buyer's real-time offered rate vs market rate. If the difference is >2%, you're losing money.

⚙️ 18. Tools to Track Your Conversion

Here are some tools that can help you get the best crypto-to-fiat rates:

-

XE.com for real-time FX rates

📸 19. Visual Guide (Image Content Idea)

Image Suggestion (Filename: crypto-to-fiat-flowchart-2025.jpg)

Image Concept:

A visual infographic showing:

-

Crypto Wallet → Exchange / P2P → Fiat Account

-

With icons for:

-

Bitcoin, Ethereum, USDT

-

Bank account, Mobile wallet

-

KYC → Yes/No routes

-

You can upload this to your blog for better engagement and SEO (with alt tag: “Convert Bitcoin to bank account 2025 flowchart”).

📢 20. Call to Action (CTA)

Want to sell crypto safely in Bangladesh or India?

Use trusted P2P platforms and avoid Telegram scams. Bookmark this guide and share it with friends who need crypto cashout help in 2025!

🧭 21. Advanced Tips to Maximize Crypto to Fiat Value

If you're regularly converting crypto to fiat, use these strategies to get the best deal and avoid losses:

1. 🕰️ Time Your Trades

Crypto prices fluctuate. Use tools like TradingView or CoinGecko Alerts to:

-

Sell when USDT/BDT or BTC/USD is at peak

-

Avoid panic-selling during dips

2. 📈 Use Stablecoins for Better Stability

Before converting to fiat:

-

Convert BTC/ETH → USDT, USDC, or DAI

-

Then withdraw from stablecoin to fiat

-

Reduces volatility risk

3. 💱 Choose P2P Offers with Minimal Spread

-

Always sort offers by “Lowest to Highest Rate”

-

Check past order count & user rating before selecting buyer

4. 💼 Use Multiple Platforms

Don’t limit to one exchange. Try:

-

Binance P2P

-

Bybit P2P

-

OKX P2P

-

Paxful

Compare and use the one with the best offer & lowest fee.

🚫 22. Common Mistakes to Avoid When Converting Crypto to Fiat

Many users lose funds or get scammed due to avoidable errors. Here’s what not to do:

🏛️ 23. Crypto-to-Fiat Regulation by Country (2025 Update)

Understanding local laws helps you stay compliant and avoid legal issues. Here's a 2025 snapshot:

📌 Always consult a local tax expert before converting large amounts!

💼 24. Building a Business Around Crypto-to-Fiat

If you’re a crypto enthusiast, consider turning it into a business:

🔧 Offer Crypto Cashout Services:

-

Help people convert crypto to fiat via P2P

-

Charge 1–2% service fee

-

Ensure trust and reliability for growth

🧾 Build a Website Like:

-

“sellusdtbdt.com”

-

“cryptotobank.in”

-

Offer 24/7 service via Telegram/WhatsApp

💡 Tools to build this:

-

WordPress + WooCommerce + Crypto Plugin

-

Laravel or Node.js backend with KYC form

-

Add Live Chat, Transaction Tracker, Rate Calculator

📣 25. Recommended Platforms (2025 Trusted List)

🧮 26. Sample Rate Calculator for Your Blog

Add this simple calculator script to your blog post to increase time-on-page and engagement:

📝 27. Summary: Your Crypto, Your Control

Crypto to fiat isn’t just about cashing out—it’s about strategy, timing, and tools. Whether you’re a freelancer, investor, or trader, you now have the power to:

-

Sell crypto at the best rate

-

Avoid scams

-

Withdraw funds fast

-

Build a side income helping others convert

This guide gives you all the knowledge to make it happen in 2025.

❓ 28. Frequently Asked Questions (FAQ)

Q1: How long does it take to convert crypto to fiat?

Answer:

It depends on the method. Centralized exchanges usually process withdrawals within 24-48 hours. P2P transactions can be instant or take a few hours depending on buyer/seller availability and payment method.

Q2: Can I convert crypto to cash without ID verification?

Answer:

Yes, through P2P platforms or OTC brokers, but be cautious as this may involve higher fees or risk. Centralized exchanges typically require KYC for fiat withdrawals.

Q3: Which crypto is easiest to convert to fiat?

Answer:

Stablecoins like USDT and USDC are easiest because they maintain 1:1 value with USD and are widely accepted on P2P platforms and exchanges.

Q4: What’s the best network to send USDT for conversion?

Answer:

TRC20 (Tron) network is recommended for USDT because it has the lowest fees and fastest transactions compared to ERC20 (Ethereum).

Q5: Are there limits on crypto to fiat conversion?

Answer:

Yes, limits depend on your platform and country regulations. Exchanges impose withdrawal limits based on verification level, and some countries have caps on crypto-related transactions.

Q6: How to avoid scams during P2P trading?

Answer:

Always use escrow services, verify counterparty’s trade history and ratings, never trade outside the platform, and never release crypto before confirming fiat receipt.

Q7: Do I have to pay taxes when converting crypto to fiat?

Answer:

Most countries treat crypto as an asset, so converting to fiat may trigger capital gains tax. Consult a tax advisor for your jurisdiction.